Why interest only vs capital repayment has only one winner in the world of investment

A common question asked of those new to property is; how do I pay off the mortgage to own this property outright?

It’s understandable why people may ask this. For YEARS, most of us have had drilled into us, that it is the DREAM to pay off your mortgage, to be able to live without that debt, and people so often transfer that mindset to investment property.

Yet it can actually COST money to take this approach! To understand why, we need to look at the question of interest only vs capital repayment mortgages – and share with you why ALL investments we make, and all investments our investors make, are on an interest only basis!

Interest Only & Capital Repayment, what are they?

A capital repayment mortgage is what most people think of when they first think of mortgages. You take out a loan against a property, let’s use £100,000 for simplicity’s sake, and over the term of the loan, let’s say 25 years, you pay both the interest on that loan, and you pay the capital down year on year, so that by the end of 25 years, the balance reaches zero.

For mathematical reasons, it’s not quite as simple as paying off £4,000 per year (the £100,000 divided by the 25 years) plus the interest. However, a capital repayment mortgage of this amount at an interest rate of 3.5%, would cost you £500.62 per month.

Meanwhile, an interest only mortgage would mean you are paying ONLY the interest aspect of this. At 3.5%, this would equate to £291.67 per month, a substantial difference in cashflow.

When we consider that a property valued around the £133,000 mark, with a £100,000 loan, may rent for in the region of £700, the difference between £200 gross profit per month and £408 gross profit per month, is quite substantial.

But what happens at the end of the term?

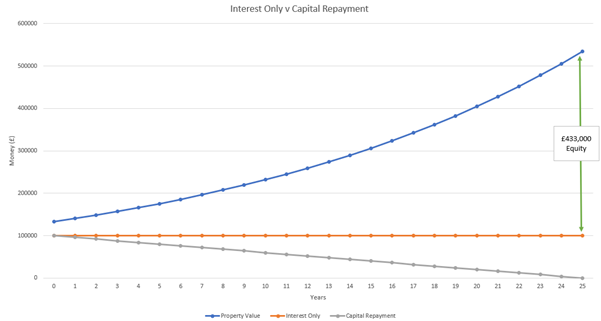

So this is great for now, we get more cashflow. But what happens in 25 years’ time? Well, take a look at the graph in the image above.

The X axis shows time (years) while the Y axis shows value. Let’s assume that property doubles in value every 12.5 years (the average is actually quicker than this – property prices were an average of £1,890 in 1950, but over £240,000 by 2020, doubling on average every 10 years), but we want to be conservative. Remember this is for illustrative purposes, so even if you don’t think the price will double in 12.5 years (despite the historic evidence), it should still illustrate the example.

Our property (originally bought for £133,000) in this example, has double to £266,000 in 10 years, and up to £533,000 in 25 years. We can see that the house bought on an interest only mortgage, has equity of £433,000, while the capital repayment mortgage, has equity of £533,000.

Both of these are very high. For the first question, what happens at the end of the term – the owner of the interest only house can simply refinance the property- after all, they have over £400,000 of equity! They can refinance it, or sell it depending on their goals – the thing is the ASSET goes UP in value, while the DEBT stays the SAME – all of that upside is yours

It’s all about your opportunity cost

You may be thinking, that’s all very well, I can see how it’s not so much of a problem to pay off the loan in 25 years time. However, why wouldn’t I pay it off over the years?

The extra income now has a very large opportunity cost. Opportunity cost is the loss of other alternatives when one alternative is chosen. When we are paying off our capital repayment mortgage, we are putting £208.95 to pay off very LOW-COST debt – debt that is, as we can see above, is working for us.

Alternatively, we could invest that money into marketing, into our business, into the property itself (to add more value), or, towards buying ANOTHER property.

Now the added income from one deal is £62,685 over the life of the mortgage, and we can USE that for a deposit for another property. We can start to see how, with two or three houses, we can either be paying down low-cost debt, or, we can be continuing to invest to grow our asset base.

This opportunity cost can be summarised in one key question:

If someone gave you the choice between putting £208.95 into an account at 3.5% per year, or, investing that money in property, which would you choose?

It’s facilitating your goals.

If building a nest egg is your goal, if continuing to invest and build your asset base is your goal, or even if simply to grow your income is your goal, it’s clear from the above we should choose the interest only mortgage.

This is not to say there are never reasons to choose the alternative- but I’d rather own more properties which work for me, rather than have fewer that are completely paid off – to grow my wealth!